If you’re new to being a self-employed taxpayer or you’ve hired an independent contractor for the first time recently, one of the first things you need to understand is the different tax forms you’ll be dealing with. In this article, we will focus specifically on IRS Form 1099-NEC, which details nonemployee compensation.

At a glance:

Form 1099-NEC, Nonemployee Compensation, is a tax form specifically designed to report payments made to those who aren’t considered employees. Freelancers, independent contractors, or those who are otherwise self-employed, may receive one or more 1099-NEC forms from clients detailing how much they were paid during the tax year. As a payer, you’ll need to file this form to comply with IRS rules. As a payee, you’ll need this form to correctly report your income when filing your income tax return.

If you provide services as an independent contractor, freelancer, or self-employed individual during the year, your payers must send you a 1099-NEC form detailing your compensation if they paid you at least $600 during the year.

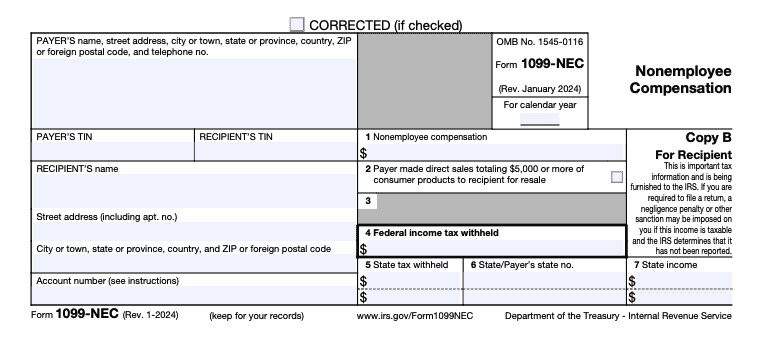

Here’s a visual example of Form 1099-NEC to help you understand the layout and information reported on this tax form:

Nonemployee compensation refers to compensation paid to independent contractors who are not traditional employees. While employers will automatically withhold payroll taxes for employees, independent contractors will likely not have any taxes withheld from their pay. And if no tax is withheld from your pay, you’ll have to make those payments yourself each quarter.

Your 1099-NEC form simply reports the total amounts you were paid during the year from each payer. This form helps the IRS track income you receive outside traditional employee-employer relationships.

Here’s a breakdown of what information you’ll find on your 1099-NEC form:

If you choose to file with us at TaxAct ® , we can help walk you through reporting your 1099-NEC income on your federal and state income tax returns.

The 1099-NEC form is relatively new. Before its introduction, payers would instead report nonemployee income in box 7 on Form 1099-MISC.

While the 1099-NEC form focuses explicitly on reporting nonemployee compensation, the 1099-MISC covers a broader range of miscellaneous income types such as rent, royalties, prizes, awards, and other types of payments.

Payers must file form 1099-NEC and send copies to recipients by Jan. 31 of the following tax year. This can be done by paper or electronic filing, and failing to meet the January due date can lead to penalties. Penalties for late or incorrect filing can be steep, ranging from $60 to $310 per form in 2023, depending on the duration of the delay and the negligence involved.

Filling out an IRS 1099-NEC form as a payer involves several key steps to ensure accuracy:

Once the form is completed, review it thoroughly for any errors or discrepancies before submission. Ensuring accuracy prevents potential issues with the IRS and avoids the need for corrections later.

Send Copy A to the IRS and give the recipient Copy B. Some state departments require that you send them a paper copy of the 1099-NEC form. If so, send Copy 1 to the state tax department.

To ensure an even smoother experience, try filing your 1099-NEC form electronically. The IRS allows you to e-file 1099 forms using their Information Returns Intake System (IRIS). This free service simplifies the filing process, allowing you to do so quickly and conveniently. You can request automatic extensions, and there is an option to bulk file. If necessary, you can also use this method to file corrected 1099-NEC forms.

The 1099-NEC form is vital for accurate reporting of nonemployee compensation. As a 1099-NEC payer or recipient, you should understand what gets reported on this tax form, the deadlines for filing it, and the importance of accuracy to mitigate any potential penalties and ensure a smooth tax-filing experience for everyone.

File your self employed taxes with confidence.

Backed by our $100k accuracy guarantee.